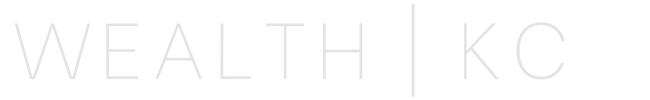

Credit Card Debt: Pandemic Payoff to Unsustainable Spending

I’ve written about or shown this graph several times over the past two years, and we’ve finally gone full circle. This first chart shows that credit card balances steadily increase with time and demographics from 2018 to early 2020. When the pandemic hits, spending slows, and the government passes out a bunch of money.

In a matter of months, consumers pay off over $120,000,000,000 worth of credit card debt. ONE HUNDRED AND TWENTY BILLION!!!! Incredible. An opportunity to completely alter the trajectory of consumer debt in our country. Now all we needed to do was spend less money than we make. That’s it - a simple math problem.

Spending < Income

But a little Y.O.L.O., “keeping up with the Joneses”, and immediate gratification quickly overpower discipline.

Now we’re back to square one.

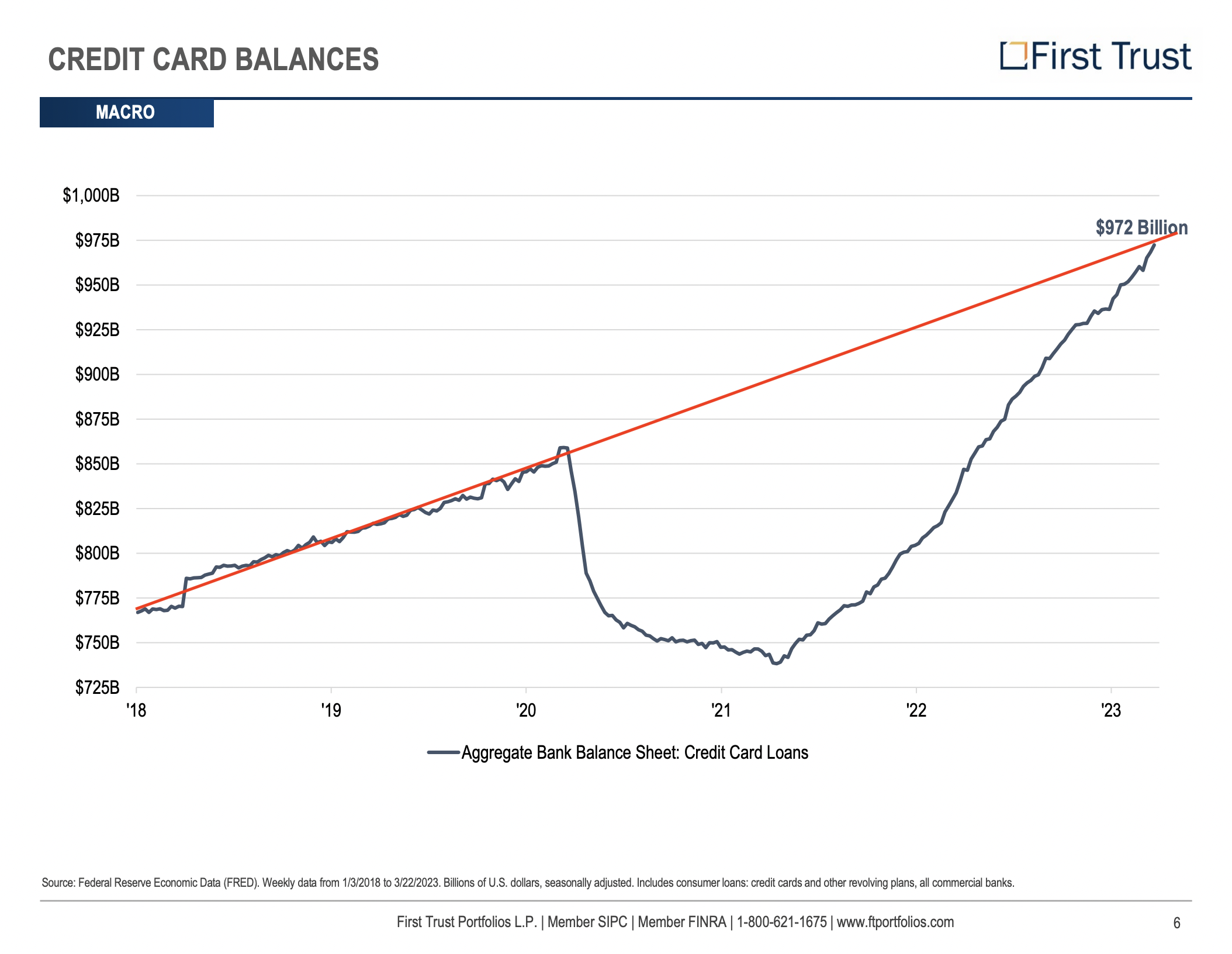

In the chart below, you can see the red trend line I’ve been drawing on this graph for the last year and a half; we caught right back up. The average person just wasted an incredible opportunity to improve their finances and set themselves up for a brighter future. Unfortunately, we now have roughly 125 BILLION more in credit card debt than when the pandemic started and 225 BILLION more than the low mark in the early part of 2021.

Following our simple math problem above (spending<income), this gray line of total credit card debt should have taken a decade or more to catch up.

Instead, it took less than two years.

What should have happened? Something like the green line below. A resumption of the same trend that had been going on for a long time. Now before you go shouting about inflation, let me first say, sure, inflation could have caused the green line to be a bit steeper than the original trend but not what we’re seeing below. This is abundant spending. Remember, while we had inflation, we also had substantial pay raises that should have curbed the steeper trend.

Now, for the bigger problem.

A new trend, an unhealthy and unsustainable trend. The blue line below. I fear the people spending on these credit cards have created lifestyles they can no longer support.

While interest rates were at rock bottom, credit card payments were at record lows, and nobody had to make student loan payments - cash savings skyrocketed. Once the Covid shutdowns were over…KABOOM! Spend, spend, spend.

New houses, cars, RVs, boats, memberships, subscriptions, you name it.

All sorts of new things and new hobbies. Golf, my personal favorite, has seen an incredible influx of new players. And trust me, or ask my wife, it’s not a cheap sport. And while golf is just one example, we can use it as a microcosm. Instead of our normal eating out, having drinks, going to weddings, traveling, putting gas in the car, kids activities, etc, many had extra cash to start new things, play golf, buy new clubs, use the best balls, and wear the best clothes.

Now that it’s time to return to normal, it’s too late. Tom, Dick, and Harry don’t want to quit or reduce their golf. They don’t want to stop playing the newest clubs or start playing that scuffed ball they found in the woods. To fund both these lives, they swipe their credit card, and it’s out of control.

This new trend line needs to slam on the brakes really fast. It needs to take a hard right and resume the pre-covid trend. Otherwise, in a few months’ time, it’ll all come to a head. The joy ride will be over, and the effects on the economy will be substantial.

“The ability to discipline yourself to delay gratification in the short term in order to enjoy greater rewards in the long term is the indispensable prerequisite for success.”

– Brian Tracy

Shean